WRITTEN BY JOHN CASSILLO

Source: www.tvrev.com, May 2023

It wasn’t too long ago that U.S. sports fans were living in a golden age of TV viewing.

Major domestic leagues and college conferences all had prominent deals with the top broadcast and cable networks, and anything that wasn’t on a primary network could usually be found on either the WatchESPN streaming overflow feed or on a regional sports network that was part of a cable package you likely subscribed to.

As someone who covered sports and an avid fan myself, this made things pretty simple. I knew where I was going to watch team X or team Y, and thus my subscriptions were at a minimum. Unfortunately, much has changed in the years since.

For all of the good streaming has done for the proliferation of content overall, that proliferation has also led to significant fracturing. As one account pointed out on Twitter this week, you’d need FOUR different subscriptions – Peacock, Amazon, YES Network and Apple TV+ – to watch the New York Yankees over a seven-day stretch.

While that means more national exposure for the Yankees, more money for the club and more opportunities for streaming services to bring in subscribers, the loser in this situation is undoubtedly the fan. As a Mets fan, I typically avoid taking pity on Yankees fans. But a look at the financial investment for a full season of Yankees baseball shows how their wallets are suffering:

-

MVPD (with ESPN, Fox, Turner): Min. $60 per month

-

YES Network: $20 per month with annual DTC subscription

-

Apple TV+: $7 per month

-

Amazon Prime Video: $9 per month

-

Peacock: $4.17 per month

This also assumes that Yankees fans don’t have additional sports interests as well. An out-of-market fan of the Yankees and Knicks is adding on another $50 for the year, at least, for NBA League Pass. Like the Rangers as well? You’ll need ESPN+ at $8.33 per month with a full-year subscription. And what about the Giants? If you’re out of market, you’re paying for NFL Sunday Ticket at a minimum of $249 for the season – only if you’ve signed up early and you are a YouTube TV subscriber – with the potential addition of maybe another $40 for the season if you want more Giants content on NFL+.

You can see how quickly the price tag escalates for fans, who are no doubt frustrated at this point between the increasing cost AND inability to easily locate games on a day-to-day basis. That’s already the case today too, when things are relatively “easy” in comparison to what’s likely to come next.

ESPN dropped a bit of a bomb on the entire TV industry during Upfronts last week, when it was revealed that the “Worldwide Leader in Sports” is working on a direct-to-consumer streaming app. Yes, ESPN+ currently exists, but that’s just overflow content and a place to watch ESPN content for those already subscribed elsewhere. This new app would be the flagship network and its full offering available for consumers, without being tethered to the larger cable bundle.

We have no idea what that app will cost, but regardless of price, it becomes yet another place that consumers will need to turn to in order to watch their favorite teams. And given the fact that ESPN actually increased its share of TV ad impressions during sports programming this past year – iSpot data shows a 6% rise year-over-year for ESPN – even losing a quarter of subscribers to the ESPN app could cripple cable permanently.

(via iSpot)

But wait – there’s more!

Diamond Sports’ financial troubles continue to hang a cloud over televised sports rights and those issues aren’t going anywhere either. Even if the current Bally Sports regional sports networks stay intact (farfetched), teams like the Phoenix Suns and Los Angeles Clippers are already exploring post-RSN life with local TV deals supplemented with streaming apps. That means the need for even more subscriptions if you’re a cord-cutter.

Then there are the lingering rights deals out there, which are sure to lean more heavily into streaming than their predecessors.

The NBA is in the midst of negotiating a new TV deal and the scuttlebut is that at least one streaming service will be involved, along with linear partners. Meanwhile, the Big Ten has basically broken the marketplace for college sports rights, to the point that the remains of the Pac-12 have few traditional options left and are potentially looking at The CW, ION and streaming services as the primary suitors for its own new deal – one that will almost certainly have the conference at a disadvantage in terms of audience, even if not TV revenues.

Such a fractured future for sports fans also portends a fractured future for TV, as the medium relies so heavily on live sports content for the ad dollars keeping linear afloat. That much was blatantly obvious during upfronts this year, especially with the writer’s strike limiting what ad inventory networks could sell with certainty.

But there’s a limit to how big the pie can get for live sports, and how many different ways it can be split before networks and advertisers will discover that audience reach is suffering (if they haven’t seen as much already).

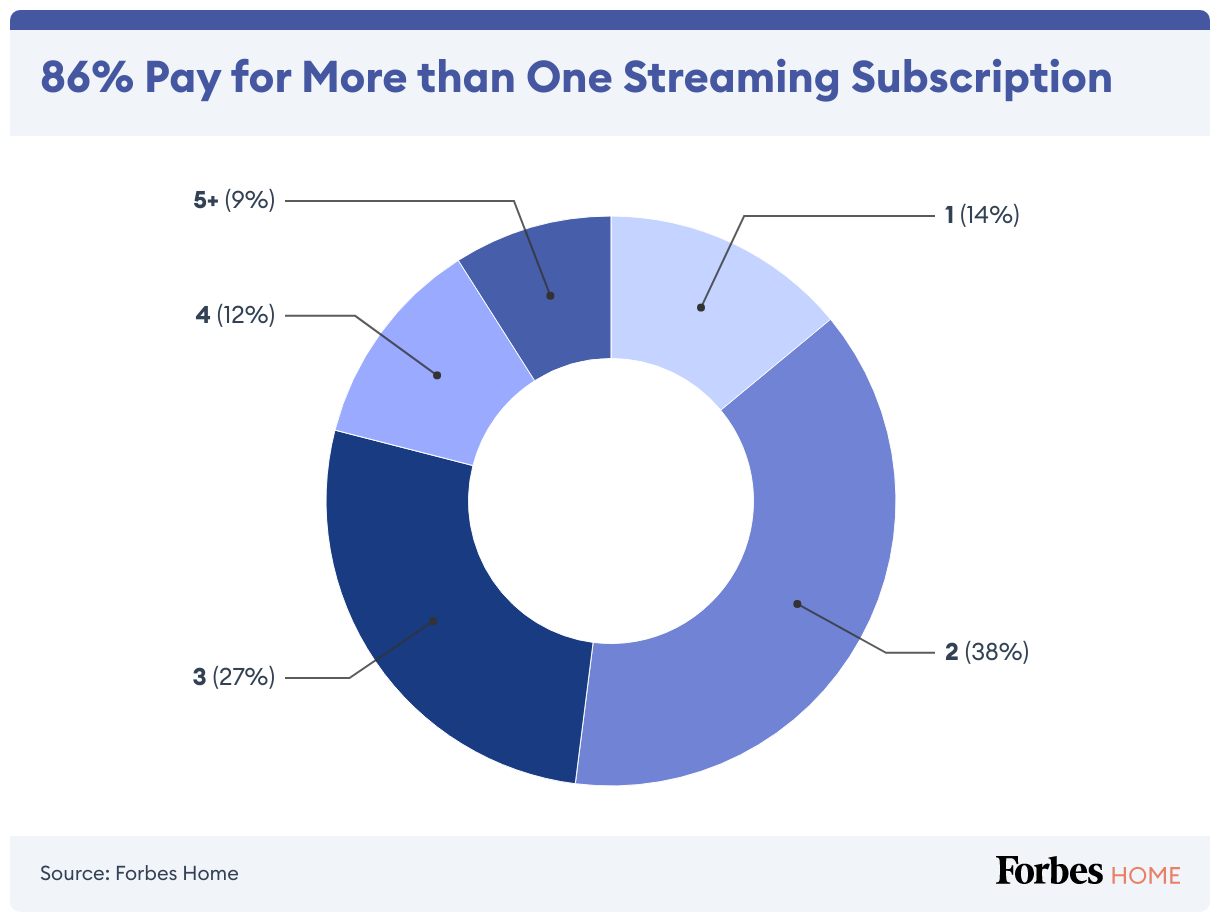

Take, for instance, the chart above from Forbes earlier this year. About 80% of consumers subscribe to fewer than four streaming services, but you’ll need at least four to watch most teams. So are consumer behaviors going to change when we’ve already seen subscription numbers plateau? Or could we see consumers either drop teams/leagues altogether?

Perhaps a third option is the most likely, though, as the one forced upon TV sooner rather than later: The Great Rebundling.

My TVREV colleague Alan Wolk has been discussing it since at least 2021, and the pressure from sports fans only makes rebundling more of a certainty. You can’t keep asking consumers to go to a variety of interfaces, nor can you ask them to pay four or five separate bills just to watch a few shows they like and a favorite team or two. Doing so is how you get younger generations to simply check out from traditional TV as we know it.

For sports and the networks/services that air them, consolidation may be the only card left to play before TV is simply chopped up into too many smaller pieces to support the financial needs of all parties involved.