Tony Hereau (L) and Pierre Bouvard at Hispanic Radio Conference 2024

Source: radioink.com, June 2024

“If you think you’ve covered Hispanics with a TV buy, think again,” was the message behind never-before-seen data presented at Radio Ink‘s Hispanic Radio Conference 2024, showcasing the power and reach of radio, especially compared to other traditional media.

As noted in March 2023, radio’s total audience has overtaken television’s for the first time in media history, and that lead has only grown by the second report in March 2024. But what about in the Hispanic demographic?

Cumulus Media/Westwood One Chief Insights Officer Pierre Bouvard and Nielsen Vice President of Cross Platform Insights Tony Hereau shed light on the significant influence of radio over television in capturing the Hispanic market to a packed room.

The presenters opened by highlighting a dramatic shift in media consumption among Hispanics, noting a significant decline in traditional TV viewership. 53% of Hispanic adults watch less than one hour of TV per day, or none at all. For comparison, radio reaches 87% of Hispanics, compared to 64% for television – a number that has dropped from 88% in 2017.

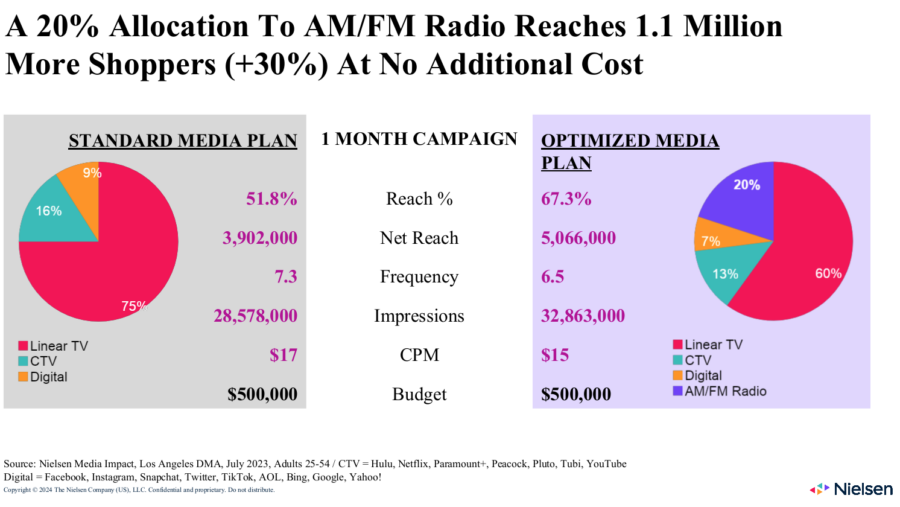

Bouvard and Hereau illustrated how incorporating AM/FM radio into media plans could substantially enhance campaign effectiveness to reach Hispanic audiences without additional costs.

The data revealed how allocating 20% of a $500,000 advertising budget to radio can add 1.1 million more shoppers in a market like Los Angeles, which is a 30% increase in reach, while lowering the cost per thousand impressions by $2. This integration elevates radio to a pivotal role in media strategies, offering 19 points of incremental reach beyond TV, digital, and Connected TV.

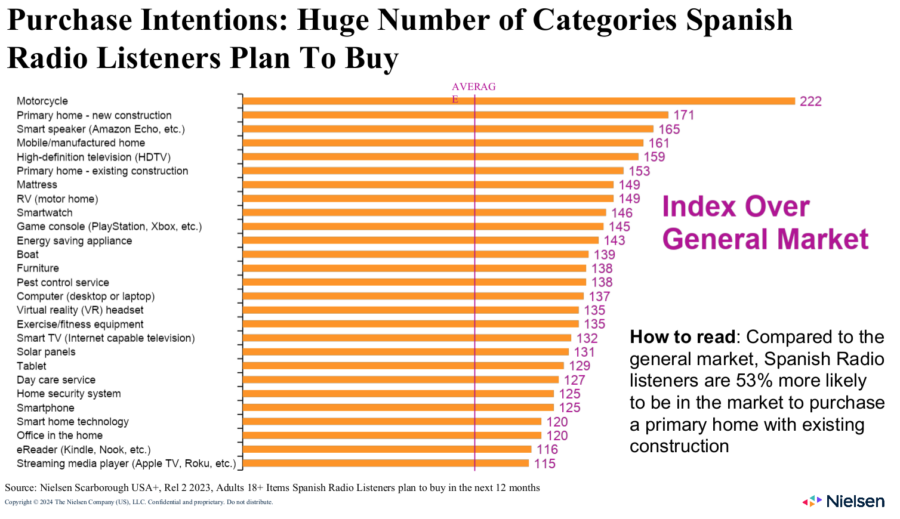

The leading categories where Spanish radio effectively moves the sales needle include automotive, casinos, foreign travel, children’s clothing, and movies. Hispanic radio listeners are 87% more likely to spend over $400 monthly on groceries and 122% more likely to purchase a motorcycle, highlighting their substantial buying power. Continued overindexing means Hispanic radio is the perfect place for many brands to capture market share and trust.

The session also covered radio’s potential to significantly expand reach in political campaigns. Nielsen Media Impact’s analysis of voter activity and Portable People Meter data indicated that excluding radio from media buys omits about 20% of voters, highlighting radio’s critical role in reaching swing voters, notably within Mexican Regional and Spanish Contemporary formats.

On the other side of the swing vote spectrum, news/talk listeners were some of the most likely Hispanic voters to have chosen a party for the election ahead.