by Wayne Friedman

Source: www.mediapost.com, August 2024

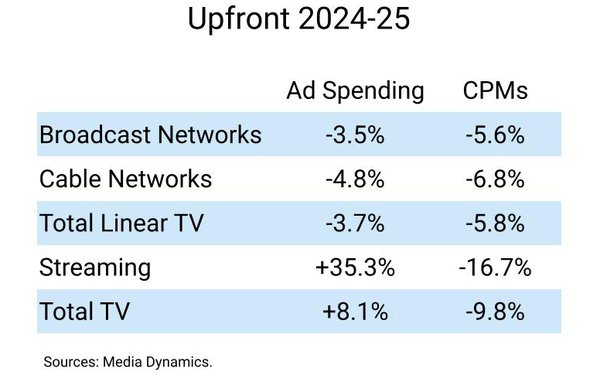

Continued rising advertising business for streaming TV platforms helped legacy TV network-based media companies ink 8% more overall dollar volume in upfront TV advertising spending, to $29.5 billion for the 2024-25 TV season, according to estimates from Media Dynamics Inc.

At the same time, linear TV deal-making — still the largest share of overall upfront advertising volume — fell 4% to $18.4 billion.

Analysts have pointed to a soft TV ad marketplace for months — coming amid increasing cord-cutting, fewer ad impressions, and declining reach.

Legacy broadcast and cable TV networks witnessed declines of 3.5% (to $9.34 billion) and 4.8% ($9.07 billion), respectively.

In better news for legacy TV-media and digital first streamers, streaming advertising upfront revenue was up 35% to $11.1 billion for premium platforms, including Disney+, Max, Peacock, Paramount+ , AMC+ as well as services like Roku, Netflix, Apple TV+ and Amazon. The previous year, streaming platforms accounted for $8.2 billion in upfront ad spending.

Advertisers make upfront TV deals before the start of a new fall TV year — in the summer — in hopes of securing key TV ad inventory throughout the season at a good price.

Traditionally, the TV season runs from September to August of the following year.

While overall total TV volume grew, cost-per-thousand viewers (CPM) pricing for all of national TV — streaming and linear — was down 9.8% to an average $31.70 for adult 18+ viewers.

Streaming witnessed the biggest decline year-over-year — down 17% from upfront ad deals of a year ago for the 2023-24 TV season to $29.50.

According to analysis from media-buying executives, the decline was due to growing competition from new entrants flooding the marketplace with new streaming inventory — especially Amazon Prime Video, which started up an ad-supported option for subscribers at the beginning of the year.

Linear TV networks’ CPMs witnessed more modest declines than streaming platforms. Broadcast networks’ adult CPMs were down 6% ($45.34), with cable networks falling 7% ($20.60).

Media Dynamics estimates $45 billion to $50 billion annually is spent in national TV advertising deals — $10 billion to $12 billion of which occurs during the “scatter” marketplace.

Scatter deals occur throughout a TV season with near-term TV campaigns starting up within weeks or days after deals have been made.

This story has been updated.